An Inflection in Emerging Display Technologies: OLEDs

Introduction

Apple iPhone 13, Samsung Galaxy S21, Google Pixel 6, Oppo Find N, Samsung Galaxy Tab S7 Plus, Huawei Mate X2, Amazon Halo View, and Apple Watch Series 7 – there is something unique about the display technology present in these consumer electronic devices. If you look at the specs of any of these above devices, you might have come across terms such as OLED or AMOLED under the type of display technology. So, what do these abbreviations mean?

OLED (Organic Light Emitting Diode) is a flat light emitting technology manufactured by stacking a series of organic thin films between two conducting components. A bright light is emitted when an electrical current is applied across this multi-layered stack. OLEDs are emissive displays that do not require a backlight. Accordingly, OLEDs are thinner and more efficient than the older LCD (Liquid Crystal Display) based display panels which require a white backlight.

There are two terms commonly associated with OLEDs' driving methods – PMOLED and AMOLED. PMOLED (Passive-Matrix OLED), as the name implies, relates to the way one electrically drives the OLED display. A PMOLED display employs a simple control mechanism in which each row (or line) in the display is controlled sequentially (one at a time). The driving circuitry for PMOLED does not contain a storage capacitor, and accordingly, the pixels in each line are in the off-state typically most of the time. We need to use higher voltage to make the OLEDs brighter to compensate for this. In contrast, an AMOLED (or Active-Matrix OLED) uses a TFT (Thin Film Transistor) array that has a storage capacitor configured to maintain the line pixels lit all the time.

In comparison, a PMOLED is extremely limited in size and resolution (usually maximum resolution is around 128x128) but is cheaper and easier to make compared to an AMOLED. On the other hand, AMOLEDs typically consume less power than PMOLEDs, have faster refresh rates, and build a larger display with higher resolutions. However, AMOLEDs are also more complicated in design and operation and expensive to fabricate.

In addition, OLED displays are energy-efficient, sunlight-readable, and have a more straightforward recycling process than LCDs. OLED displays have great contrast as the light on the screen comes from each pixel rather than backlight; when it needs to create contrast, it simply dims or turns off the relevant pixels for an actual, deep black color and consumes less power. High brightness, low power consumption, and a more excellent contrast ratio offered by OLED displays are the leading factors for their adoption in various applications.

An OLED is a thin film optoelectronic device with multiple functional organic layers (made of small molecules, dendrimers, or polymeric substances), including a hole transport layer, a light-emitting layer, an electron transport layer, and some optional layers such as a hole injection layer, blocking layer, electron injection layer, etc. These layers are sandwiched between an anode and a cathode, with the electrode typically deposited on a substrate (e.g., glass, plastic, etc.). In an OLED device, the light-emitting layer is excited by the recombination energy of electrons from the cathode and holes from the anode. Then the light-emitting layer emits light when returning to the ground state. One of the electrodes consists of transparent material to extract light from the light-emitting layer.

The organic molecules within the functional organic layers are electrically conductive with conductivity levels ranging between insulators and conductors, and hence they are referred to as organic semiconductors. The Highest Occupied Molecular Orbitals (HOMO) and the Lowest Unoccupied Molecular Orbitals (LUMO) of organic semiconductors are similar to the valence and conduction bands of inorganic semiconductors such as silicon or gallium arsenide. More information about HOMO and LUMO is available here.

OLEDs can be found in different anatomies: single-layer, two-layer, triple-layer, or multilayer OLEDs. A single-layer OLED includes a single organic layer sandwiched between the cathode and. This layer should have hole transport, electron transport, and emission capabilities to operate as an emissive device. In this scenario, the injection of both the carriers should be the same; otherwise, the device will result in low efficiency because the excess of electrons or holes cannot combine. In contrast, one organic layer is explicitly chosen to transport holes in a two-layer OLED. The other layer is chosen to transport electrons, namely the hole transport layer (HTL) and electron transport layer (ETL), respectively. Recombination of the hole–electron pair occurs at the interface between the two layers, generating electroluminescence. While in the structure of a triple-layer OLED, each organic layer has a distinct functionality and can therefore be optimized independently. Hence, the luminescence or recombination layer can be chosen to the desired emission color with high luminescence efficiency. Multilayer OLEDs consist of various layers: Indium Tin Oxide (ITO) glass substrate, hole injection layer, HTL, an emissive layer, ETL, and anode. This architecture minimizes the charge carrier leakage and exciton quenching at the interface of the organic layer and the metal electrode. The materials to be used for different layers for OLEDs should meet specific parameters such as high luminescence efficiency, adequate conductivity, good temperature stability, good oxidative stability (water and oxygen), and good radical cation/anion stability; they should also not degrade during sublimation. Various materials used in different layers of OLED are shown in the table below:

Recent Activities of Major Players

Samsung Electronics (South Korea), LG Display (South Korea), AU Optronics (Taiwan), BOE Technology (China), Universal Display Corporation (US), Tianma Microelectronics (China), Acuity Brands (US), and OLEDWorks (US) are among the major players in the global OLED display market.

WRGB OLED is LG's OLED technology (White Red Green Blue Organic Light Emitting Diode). The primary light source is a white OLED, with extra color filters adding red, green, and blue to each pixel. OLED TVs can produce true black and illuminate only the pixels that are required to be lighted because each pixel's light source may be turned on and off.

Some recent developments in the industry include:

In January 2021, LG Display demonstrated a 48-inch bendable gaming monitor at CES 2021. The whole panel is just 0.6 mm thick, which enabled its Cinematic Sound OLED (CSO) technology in the monitor, which turns into a prominent speaker. The display can bend up to a radius of 1,000 mm, so it can be used both as a flat TV and a curved screen for immersive gaming.

In June 2020, LG announced the launch of a new vivid, transparent OLED display for digital signage solutions. The new display provides cutting-edge touch screen technology and uses projected capacitive (p-cap) film technology to deliver a highly responsive, accurate touch experience. The new OLED display is built from anti-reflective, tempered, shatter-resistant front glass to make it suitable for commercial use.

In November 2020, OLEDWorks partnered with Lumenique LLC. This partnership marks Lumenique, a manufacturer of lighted artwork, an early adopter of OLED lighting technology. The firm will integrate the latest OLED lighting panels into artistic portable lighting.

In May 2020, Universal Display and Wuhan China Star Optoelectronics Semiconductor Display Technology Co., Ltd. signed a new OLED technology license agreement and supplemental material purchase agreement. Under the long-term agreements, UDC will supply phosphorescent OLED materials to Wuhan China Star Optoelectronics for display products through its wholly-owned subsidiary UDC Ireland Limited.

In May 2020, Tianma started its sixth-generation flexible AMOLED production line project. With an investment of RMB 48 billion, the project covers a total land area of about 247.1 acres. It is currently the largest flexible AMOLED monomer factory in China.

In August 2019, AU Optronics launched a 17.3-inch OLED display with UHD 4K image quality and 120 Hz refresh rate, 5.6-inch AMOLED display.

The OLED Display industry is still in the developing stage, and the world's large production is mainly concentrated in Korea. Samsung and LG monopolize the technology and market share. JOLED Inc., a joint venture of Japan Display, Sony, and Panasonic, which was set up to break the monopoly of Samsung and LG, will mainly target laptops and tablets.

Competing Display Technologies

A wide range of OLEDs, finding applications in various sectors, have entered the market, focusing primarily on passive and active matrix solutions. The central area of research in the OLED market is the development of white OLEDs with a long shelf life of more than 15,000 hours at a brightness level of 1,000 cd/m2. Also, flexible OLEDs with enhanced portability have been developed to offer bendable, lightweight, and unbreakable devices. In the next decade, OLEDs are expected to replace LCDs in most applications, ranging from small displays for smartwatches to large-sized displays for television sets.

QD-OLED

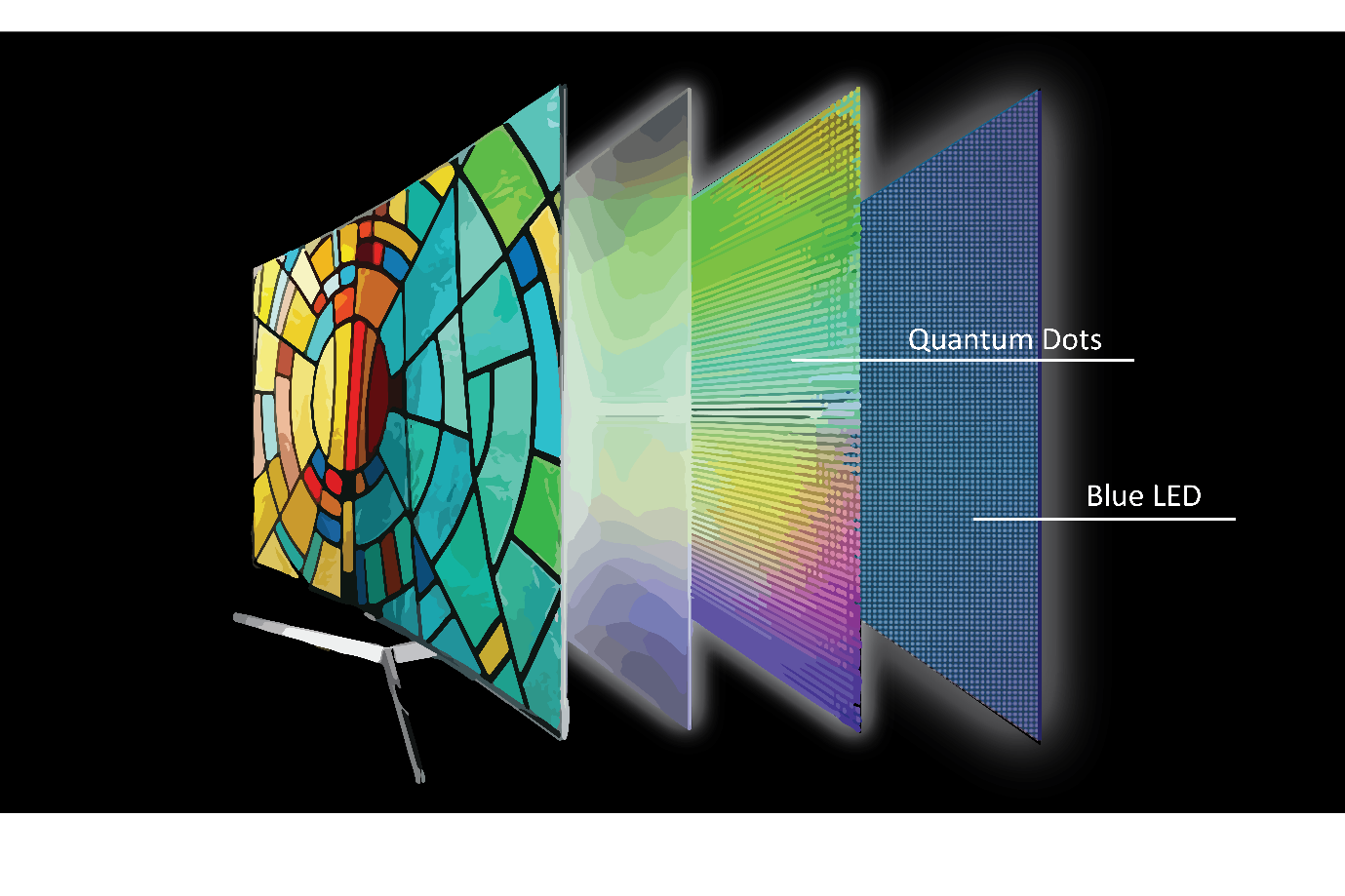

According to Samsung Display, a QD-OLED display has three main components: a TFT layer that includes an electronic circuit to pass current through the OLED material, a layer of blue OLED material that generates blue light, and a layer of quantum dots. When the blue light from each pixel is passed through the quantum dot layer, green and red sub-pixels are created, which, combined with the blue sub-pixel, make up the RGB color model. In this color model, red, blue, and green are added together to produce other colors for the pictures that you see on your TV.

Thanks to the deep blacks and high brightness, the QD-OLED panels can significantly better HDR performance than traditional OLEDs. By using quantum dots instead of a color filter for color transformation, virtually no light energy is lost. This results in a brighter display compared to the traditional OLED TV panels. And as the QD-OLED panels have self-emissive pixels, individual pixels can be dimmed to get perfect black levels.

Quantum Dot in Television (Source)

Mini-LED

Mini-LED is an LCD enhancement technology and part of the ongoing effort by LCD manufacturers to narrow the performance gap between LCD and OLED. Mini-LED LCDs use arrays of tiny LEDs (100-1,000 micron size range) in the backlight, behind the LCD panel, to give higher control of pixel illumination. Mini-LED backlights provide better dark/light contrast versus traditional LCDs by taking advantage of local dimming of multiple zones; this partially narrows the contrast performance gap relative to OLEDs.

Apple's 2021 MacBook Pro can reach a peak brightness of 1,600 nits with a contrast ratio of one million to one. That means it can attain a level of intensity that is difficult to match with OLED in large panels, and why Apple chose mini-LED instead of OLED for its 14-inch and 16-inch MacBook Pro laptops in 2021.

Micro-LED

Micro-LEDs are light-emitting diodes fabricated in the sizes of micrometers and can be used in self-emitting display manufacturing. Thus, the backlit panel is not required in micro-LEDs, and these LEDs are much brighter and more power-efficient. Micro-LEDs are expected to be the disrupting innovation in terms of display and lighting applications. Micro-LED technology can be used in both display and lighting applications.

Micro-LED is a self-emitting display technology (like OLED) using LEDs less than 50-100 microns in size, each becoming an individual red, green or blue sub-pixel. Micro-LED technology matches or exceeds OLED and LCD in almost every performance area. It has the image quality and forms factor benefits of OLED without the robustness and lifetime issues. It exceeds LCD and OLED in terms of brightness and has lower power consumption. The market for Micro-LED technology-based display panels is expected to increase due to the advantages offered by the technology over the existing display technologies such as LCD and OLED. The technology offers advantages, including the faster response time, higher brightness, more prolonged running of devices, especially for retail and corporate applications. As Samsung's state-of-the-art display, MICRO LED offers a best-in-class picture quality thanks to 25 million micrometer-sized LEDs that individually produce light and color, creating an incredibly immersive experience through impressive depth, vibrant colors, and a heightened level of clarity and contrast.

Current Applications of OLEDs

OLEDs are used today in mobile phones, digital cameras, VR headsets, tablets, laptops, and TVs. In 2021, over five hundred million AMOLED screens will be produced - primarily to meet demand from smartphones, wearables, tablets, laptops, and TVs. The leading AMOLED manufacturer is Samsung Display, and most premium phones today adopt either rigid or flexible OLED displays - including those from Apple, Samsung, Huawei, Oppo, Motorola, Sony, and others.

OLED is the best display technology - and indeed, OLED panels are used today to create the most stunning TVs ever - with the best image quality combined with the thinnest sets ever. OLEDs are used in mobile devices today because they are thin, efficient, flexible, and bright. OLEDs carry a price premium over the older generation LCDs, but companies are using these displays increasingly as performance increases and prices decrease.

OLED technology is gaining momentum in general lighting applications due to its superior performance and wide light source coverage. OLED lighting products are energy-efficient and are deployed in green buildings. The general lighting segment is expected to continue to account for the larger size of the OLED lighting during the forecast period. However, the automotive lighting segment will grow at a higher CAGR during 2021–2026. The higher growth of the automotive lighting segment can be attributed to the high demand from luxury car manufacturers (e.g., Audi, Mercedez-Benz, etc.) for premium quality lightings, along with a rise in the number of collaborations of OLED manufacturers with leading automotive companies for the development of flexible lightings for vehicles.

In the new Q5, Audi has implemented a proximity detection feature for the versions using digital OLED taillights. When another road user approaches a stationary Q5 from the rear within less than two meters, all the OLED segments light up. When the Q5 starts to move, it returns to the original light signature. The more significant number of individually controllable segments can now be randomly activated, with continuous brightness variability. In the Q5, three tiles of six units each, 18 segments per lamp, are currently used. The high precision and significant variability offer light designers a wealth of opportunities, using just one type of hardware.

The 2021 Cadillac Escalade features a 7.2-inch driver control touchscreen (all measurements are diagonal). Centered behind the steering wheel is a 14.2-inch cluster display screen. Then to the right of that is a 16.9-inch infotainment touchscreen. In addition to touch control, the latter can be manipulated with a rotary control dial that flips through items as though they are on a carousel. Together, the 2021 Cadillac Escalade features a 38-inch curved OLED display.

Nintendo Switch (OLED model) has a similar overall size to the Nintendo Switch system but a more extensive, vibrant 7-inch OLED screen with vivid colors and crisp contrast. This is a notable example of the application of OLEDs in the video gaming industry.

IP Moats in OLED Display Industry

Lumenci recently discussed why innovative companies need IP-Moats to gain a competitive advantage. In line with the above discussion, several significant players in the OLED Display industry build a competitive edge by converting innovation from existing R&D programs into patents and generating revenue from its IP. By way of an example, the patent grants related to OLEDs in the US in the last five years demonstrate how the major players in the OLED Display industry gained a competitive edge by obtaining timely IP protection. In our example, we reviewed the total number of US patent grants related to OLEDs using two CPC codes followed by the USPTO - H01L, and G09G.

The top ten assignees that obtained US grants with H01L (semiconductor device related) CPC code are below. It is interesting to note that TSMC (which does not sell any OLED displays) has obtained more patents than major OLED manufacturers such as Samsung or LG. This shows that TSMC is proactively obtaining patents related to the fabrication of the OLED device to gain a competitive edge over other foundries that might compete with TSMC as an OLED manufacturer. Secondly, TSMC may also consider generating licensing revenue from other players for the innovative process technologies involved in designing and manufacturing OLEDs developed from its existing R&D programs.

Top Assignees in the last five years with US grants on OLED Displays (CPC = H01L, Total grants = 11,387)

(Source: Lumenci)

Now, let us review the top five assignees that obtained US grants with G09G (circuits for processing control signals to achieve the display) CPC code.

Top Assignees in the last five years with US grants on OLED Displays (CPC = G09G, Total grants = 7,214)

(Source: Lumenci)

The above graph is consistent with the geographical distribution of major players in APAC. While Samsung and LG are based out of Korea, Boe Technology Group and TCL are based in China. In addition, among the top five assignees, Ignis Innovation is the only assignee based out of North America.

As an interesting case study, LG Display has unveiled its next generation of OLED TV Display called 'OLED EX' (an acronym for 'Evolution' and 'eXperience'), which implements LG Display's deuterium and personalized algorithm-based 'EX Technology.' Deuterium compounds make highly efficient organic light-emitting diodes that emit stronger light. LG Display has successfully converted the hydrogen elements present in organic light-emitting elements into stable deuterium and managed to apply the compounds to OLED EX for the first time. This helps boost the display's overall picture quality by increasing brightness up to 30 percent compared to conventional OLED displays. According to Google Patents, LG Chem Limited (a subsidiary of LG Group that owns LG Display) has obtained nearly 225 patents in the last ten years, covering the above concept of converting hydrogen elements in organic light-emitting elements into stable deuterium. This is yet another example of building a solid IP-Moat to remain competitive.

Future Outlook

OLEDs are not perfect. First of all, it costs more to produce an OLED than it does to produce an LCD - although this should hopefully change in the future, as OLEDs has the potential to be even cheaper than LCDs because of their simple design (some believe that future OLEDs will be printed using simple ink-jet processes). OLEDs have a limited lifetime (like any display, really). That was quite a problem a few years ago. But there has been constant progress, and today this is a non-issue. Today OLEDs last long enough to be used in mobile devices and TVs.

Among all regions, APAC (China, South Korea, Japan, and India) is expected to register high growth in the OLED market. The high growth of the market in APAC can be attributed to the increased government investments in the education sector and the presence of some of the critical display manufacturers, such as Samsung, LG Display, Sharp Corporation, and Panasonic, in the region.

The consumer electronics market is growing amazingly fast with remarkable advancements in technology, such as improving picture clarity in large-screen TVs and the evolution of smartphones. OLED technology enables the development of these advanced products. Factors driving the demand for OLED products in the consumer segment include technological advancements in consumer devices and economic growth worldwide.

The adoption of OLED displays in the automotive industry is likely to increase in the coming years. The rapid adoption of ADAS, flexible panels, OLED screens, and increasing sales of premium segment vehicles are the major factors driving the global automotive display market.

In summary, the future of OLEDs looks very bullish, at least for the next fifteen years. It is crucial to protect the innovations arising from existing R&D programs of each of the major players in the OLED display market. Furthermore, these significant players should also anticipate and safeguard future technology shifts by building strong IP-Moats that can provide competitive advantage even during rapid technological disruption and possible loss of market share.

Author

Editorial Team at Lumenci

Through Lumenci blogs and reports, we share important highlights from the latest technological advancements and provide an in-depth understanding of their Intellectual Property (IP). Our goal is to showcase the significance of IP in the ever-evolving world of technology.