Mobile Wallets – Innovative, Secure & Convenient Mode of Payment

Mobile wallets allow users to pay using a payment platform rather than cash, cheque, or credit card. Mobile wallets generally refer to apps on a smartphone or smartwatch that contain the user's debit or credit card information. They allow users to pay for goods and services digitally using a mobile wallet. Mobile wallets will generally be part of a smart device with a Near Field Communication chip (NFC) installed, allowing it to communicate with a terminal to send and receive the information necessary to process a payment.

A mobile wallet system can take different forms. The first form is an integrated system like Samsung or Apple Pay. These mobile wallets come preinstalled on devices and can even have some special hardware installed that might give them some advantage over purely software-driven solutions. The main drawback of these mobile wallet platforms is that they are generally locked down to only products made by the company that designed the application, so they are not as convenient for someone who might use a myriad of devices.

The second form is PayPal, CashApp, or Venmo. This flavor of mobile/digital wallets can be used on almost any smart device just by downloading the app, but you can also use them on computers as a digital wallet solution. The differences between these two solutions come down to picking a narrower solution that might work better in some instances or a broader solution that you can access on any internet-connected device.

Security

Mobile wallets can also help protect users from getting their credit card information stolen because, with a standard credit card, anyone can take a picture of the information on the card or even steal it. When using a mobile wallet, the person would have to steal the entire phone and still would not have access to it if you have the phone adequately secured.

The mobile wallet market has grown rapidly over the past 10 years; as cell phones become ubiquitous, people don’t want to carry more things in their pockets like a physical wallet. So they can pay for everything using their phone, which they usually would do. Global Market Insights states that the Mobile wallet market will have a 970-billion-dollar valuation in 2030.

Patents

One early relevant Patent was filed in 2000 defining authentication in a telecommunications network (US7660772B2). This is a foundational patent that describes a process of a payer taking the contact information of a payee to pay to the payee’s account using a wireless/cellular terminal.

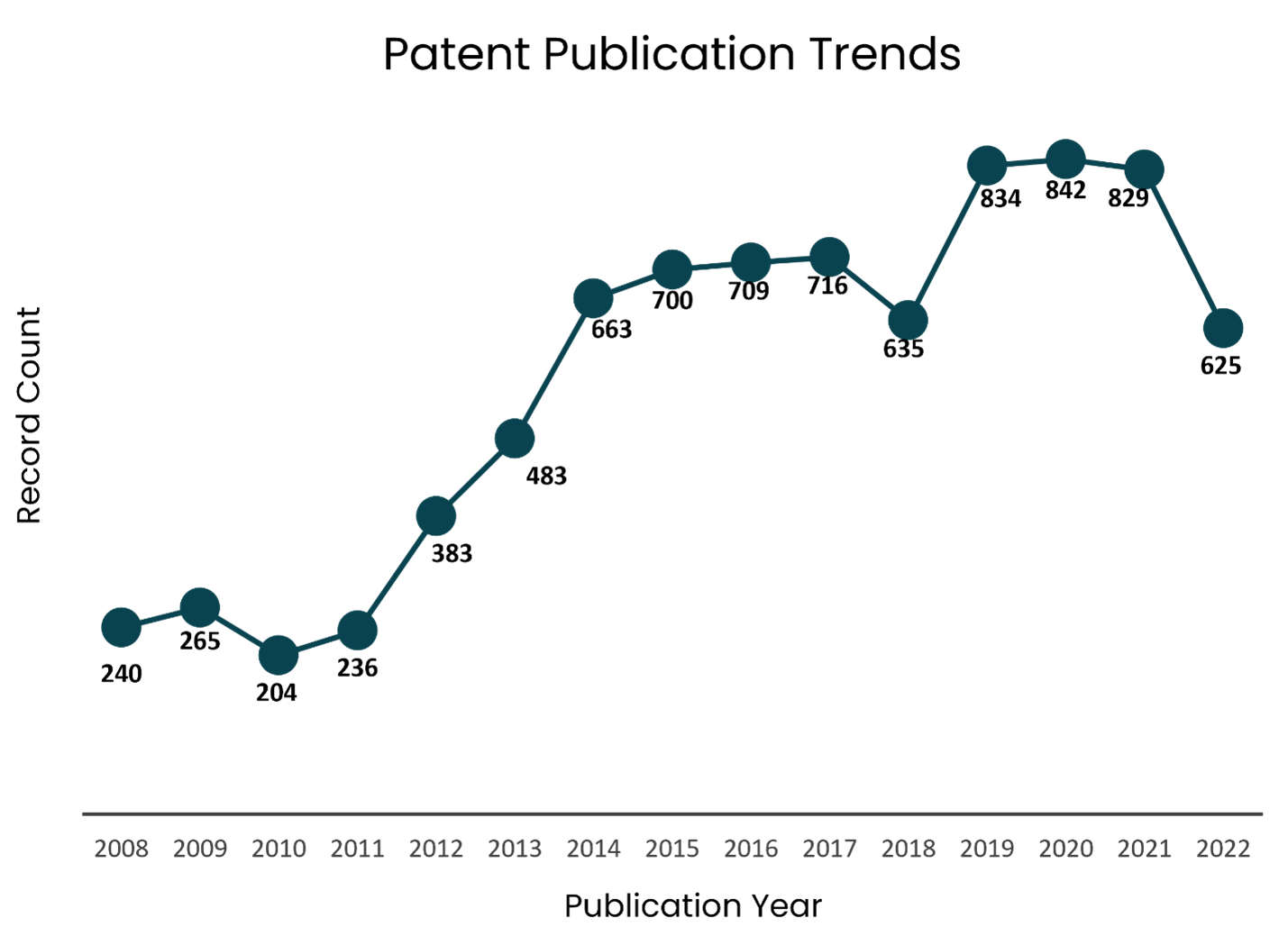

Since this patent, we have only seen an increase in the number of patents filed for mobile wallets.

Patent Publication Trend

With the largest number of patents, we can see the finical services giant Visa at the top with over 1700 patents granted, followed closely by Apple, which built-up Apple Pay as their mobile payment solution accepted at most stores across America. The rest of the major players are financial service companies or tech companies.

Top 15 Patent Holder

Apple is ranked 13th, but is second in terms of the overall number of patent publications (issued patents and pending publications). With 86 inventions, Samsung stands out as the strongest rival among IT companies.

Conclusion

Mobile wallets are already ubiquitous, with more and more people switching to them. As technology improves and people become more comfortable with them, we can expect to see people move away from physical credit cards to cut down on the number of items they need to carry on them. However, it is more than waiting for people to become more comfortable with the idea; since mobile wallets are more convenient and reliable, people trust them over carrying a physical card.